36+ tax deduction for mortgage interest

Web Mortgage interest. Ad Face-to-Face Tax Prep In-Person or Virtual.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Upload Your Tax Docs Beforehand.

. Taxes Can Be Complex. You can deduct the interest you pay on your mortgage up. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other.

Married filing jointly or qualifying widow. Complete Edit or Print Tax Forms Instantly. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly.

Ad Face-to-Face Tax Prep In-Person or Virtual. Get Help with Tax Prep From an Experienced Tax Pro at HR Block. That cap includes your existing.

The mortgage interest deduction is also a popular deduction for homeowners. Web Mortgage Interest. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Web Heres how to claim the home mortgage interest tax deduction and what to expect in the process. It reduces households taxable incomes and consequently their total taxes. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Ad Access Tax Forms. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. For tax year 2022 those amounts are rising.

Web Most homeowners can deduct all of their mortgage interest. How To Claim Mortgage Interest on Your Tax Return You must. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every.

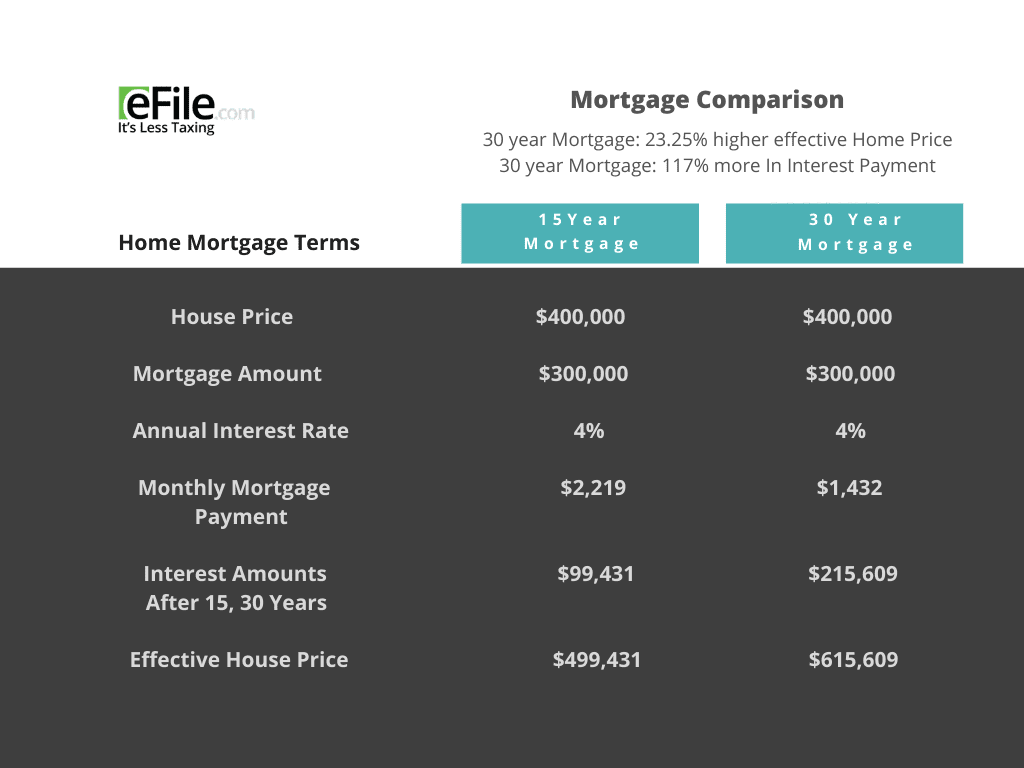

Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Web For 2021 tax returns the government has raised the standard deduction to.

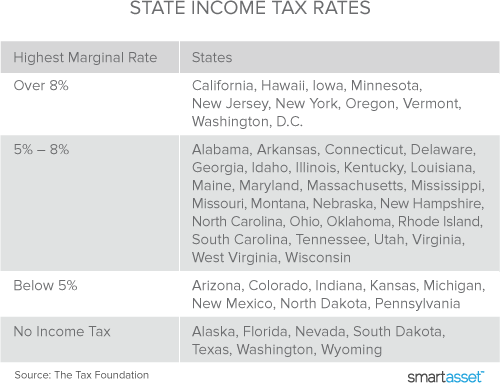

Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Web In fact the mortgage interest tax deduction primarily benefits taxpayers making more than 200000 according to the Tax Foundation an independent. But for loans taken out from.

Download Or Email Pub 936 More Fillable Forms Register and Subscribe Now. Web For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre married and file separately regardless of. Get Help with Tax Prep From an Experienced Tax Pro at HR Block.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Another itemized deduction is the SALT deduction which. However higher limitations 1 million 500000 if married.

Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Single or married filing separately 12550. Web On his 2012 federal income tax return Brother C deducted 66354 of mortgage interest paid relating to the Paradise Valley propertyhalf of the total.

NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. Web For tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household. Web 1 day agoFor tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Upload Your Tax Docs Beforehand. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly.

As each half amounts to. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Mortgage Interest Tax Deduction Limit For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000.

Web 1 day agoOne of the major downsides of being self-employed is that you have to pay both the employer and employee portions of Social Security tax. Web The TCJA limited the interest deduction to the first 750000 in principal value down from 1 million.

Haiboxing Remote Control Car 4wd Rc Car 1 16 36 Km H High Speed Rc Monster Truck 2 4 Ghz Racing Car Waterproof Off Road Car Toy Gift For Children And Adults Amazon De Toys

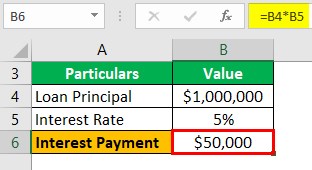

Mortgage Interest Deduction How It Calculate Tax Savings

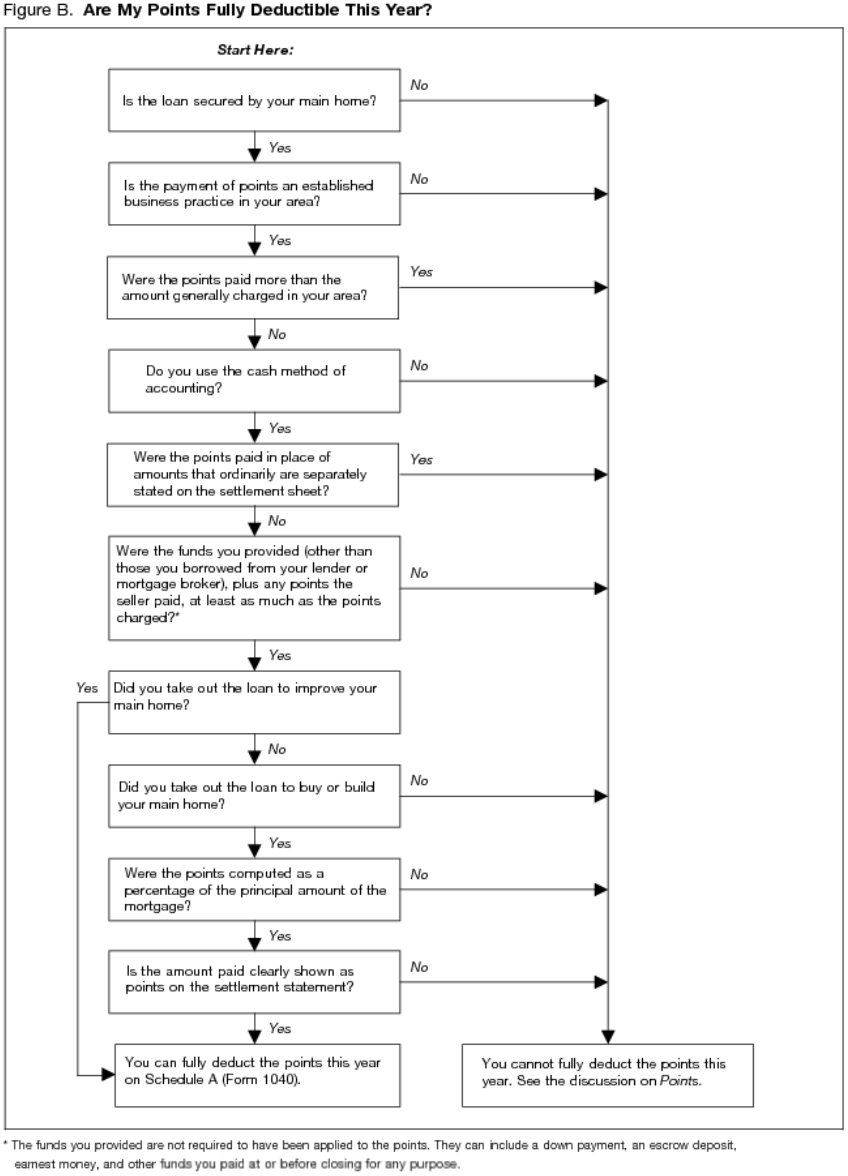

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

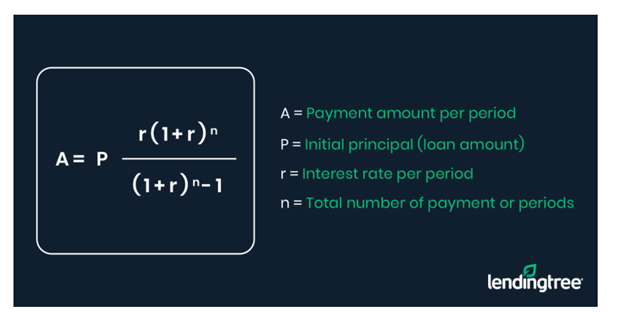

The Home Mortgage Interest Deduction Lendingtree

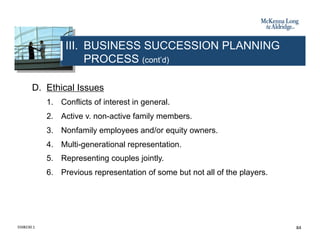

Business Succession Planning And Exit Strategies For The Closely Held

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

It S Time To Gut The Mortgage Interest Deduction

![]()

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Be A Success Maverick Volume Two How Ordinary People Do It Different To Achieve Extraordinary Results Finck Paul Amazon De Books

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Home Mortgage Loan Interest Payments Points Deduction

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Mortgage Interest Tax Deduction Smartasset Com